Who knows

the Japanese business best ?

If you are interested in our business information on Japanese companies while you are located outside Japan, please contact D&B offices in the country where you are located:

Contact Us

TOKYO SHOKO RESEARCH, LTD.

TOKYO SHOKO RESEARCH, LTD. (TSR) was established in the 19th century(1892)as the first credit reporting agency in Japan.

Since then, for over 130 years, TSR has been supporting business scenes in Japan from the standpoint of professional corporate analysis. Over a century experience enables us to have a nationwide network and abundant corporate data. With these advantages, TSR plays a key role in the 21st century.

Reliable data of TSR is a key to success in the business in/with Japan.TSR will be a guide for your successful voyage.

TSR strives to provide the best business information of Japanese business.

Company Profile

About Us

| Company name: | TOKYO SHOKO RESEARCH, LTD. (TSR) |

|---|---|

| Corporate Headquarters: | JA Bldg., 1-3-1 Otemachi, Chiyoda-Ku Tokyo 100-6810, JAPAN Map |

| President: | Mitsuo Kawahara |

| Paid-in Capital: | JPY 67,000,000 yen |

| Founded: | 1892 |

| Branches: | 82 |

| Employee: | 2,035 people(as of 31 March, 2025) |

| Products & Services: | Credit Reporting, Database Services, Marketing Research, Publishing, etc. |

To visitors who are interested in our products

TSR products and services are unavailable to the customers abroad. If you are located outside Japan and interested in business information reports or database on Japanese companies, you could contact our alliance partner, the D&B Corporation (dnb.com). Please do not hesitate to ask us for more information.

D&B's products and services are drawn from a global database of more than 600 million commercial entities. They have global data coverage on business records in over 240 countries. Since they have their subsidiaries and partner companies around the world, you could find D&B’s products in your country or your neighboring country.

Map

| Address: | JA Bldg., 1-3-1 Otemachi, Chiyoda-Ku Tokyo 100-6810, JAPAN |

|---|---|

| Access: | 1 minute from the EXIT C2b of Otemachi Station(M18,T09,C11,Z08,I09) on foot. |

| TEL: | +81-3-6910-3142 |

| FAX: | +81-3-5221-0712 |

Privacy Policy

Tokyo Shoko Research (TSR) has collected business information to support customers make commercial decisions. Personal Information is included in the collected information.

TSR will handle Personal Information in accordance with the following privacy policy.

- TSR will comply with all applicable laws and regulations.

- TSR deals with Personal Information only for the scope and purpose when needed TSR updates Personal Information and maintains accuracy.

- TSR will build personal, physical, technical and organizational safety to protect Personal Information.

- TSR reports to matters regulated by law to Japan's Personal Information Protection Committee.

Please visit the website of the Personal Information Protection Committee(Date平成29年4月26日、Number2017-000019).

Customers, Suppliers

Purpose

TSR uses Personal Information of customers and business partners for smooth communication and commercial transactions.

● In order to check customer’s usage status for services provided by TSR, to supply products and services by TSR, and to make settlement

● For the approach to dealings with customers, such as sending product information on TSR

● To identify tsr-van2 users

(*)TSR does not disclose Personal Information of customers and business partners without consent or legal permission.

Security

TSR protects the Personal Information of customers and business partners, and takes appropriate measures so as not to be damaged, lost, or altered by illegal disclosure, access, accidents and illegal activities

Contact

We will respond to requests from customers and business owners concerning Personal Information of customers and suppliers maintained by TSR if they are requested.

Purpose

● Shareholders

To fulfill obligations, exercise of rights

For dividends

For management and administration

● Candidates to recruit

For recruitment activities

For statistics and making material

● Employees (including officers, employee's families, and retirees)

Employment Record / Change of Position / Payroll / Criminal History Confirmation / Qualification Skill Confirmation of Technical Knowledge / Welfare Management Operation Including Health Care and Pension and Life Insurance / General Affairs Management Operations / Visiting Opportunities / Career Development / Disciplinary Matters /Business Trip / Time Management / Performance management / Budget and Financial prospects / Decisions on Salary and other benefits Review / Retirement Pension / Compliance with Applicable Legal and other Provisions, Training / Learning Service Provision / Communication / Security Management / Emergency Contact / Compliance with other Labor Obligations including Applicable Law Regulation and Regulatory Investigation / for Auditing Compliance with Corporate Policy and Contract Obligations

Shared use

TSR shares personal information for the health of employees with Tokyo Shoko Research Health Insurance Association.

Contact

TOKYO SHOKO RESERCH, LTD

The Dept. Personal Information Protection

Ootemachi 1-3-1 Chiyoda-ku Tokyo

100-6810 JAPAN

tel;+81-3-6910-3120 (GA dept. for Stockholders and Inquirer)

+81-3-6910-3122 (HR dept. for Applicants for TSR jobs and Employees)

(9:00-17:00 Japanese Time)

● Method: Send the following items to the designated address

- Application form filled in blank

- Copy of identification (eg. ID Card )

- Small change order certificate 500 yen worth

- Return envelope with stamp

- Power of attorney (when delegating charge)

● Remarks

- If the request is not your own Personal Information, in case of Personal Information not owned by TSR, if TSR can’t verify your identity, if TSR can’t confirm facts as requested content, TSR can’t respond to requests for disclosure, correction, addition or deletion.

- In the case of 1, TSR will not return a fee.

- TSR will promptly notify you of results by mail.

Purpose

TSR investigate companies for customers to need company’s information to make commercial decisions or research. Categories of investigations are general, whole companies, contain indispensable Personal information to grasp company’s existence and condition, such as source of Representative Director. TSR utilizes Personal Information of Inventory Data Subjects only for providing to customers.

How to Collect

- Interview with Data Subjects or staff concerned by meeting, telephone, fax, and mail.

- Reference to the disclosure by public organizations, such as the Commercial Registry, the Real Property Registry.

- Reference to the disclosure by own websites and media

- Import through companies allied with TSR

Categories

| Representative Director | Name,Called position,Address,Gender,Birthday,Birth place,Phone number,Marital/partnership status, Education,Hobbys,Work history,Bankruptcy history,Tax amount,Housing |

|---|---|

| Member of the board of directors,Officers | Name,Position,Title,One's stock holdings, |

| Stockholder | Name,address,One's stock holdings |

| Property | Owner/Address,Name&Address of Mortgagee,Name&Address of Debtor |

How to provide to third parties

1. TSR report ... Personal delivery, mailing, Internet of tsr-van2 /DBIA

2. TSR Data Base service ... Internet of tsr-van2, CD-ROM or CMT , personal delivery or mailing

Inquiry

TSR will cease providing personal information of that person upon request from the person himself / herself. Disclosure, correction, addition, deletion of personal information maintained by TSR also can be requested.

Contact:Tokyo Shoko Research

The Dept. Personal Information Protection

Ootemachi 1-3-1 Chiyoda-ku Tokyo

100-6810 JAPAN

tel;+81-3-6910-3136 (9:00-17:00 Japanese Time)

● Method: Send the following items to the designated address

- Application form filled in blank

- Copy of identification (eg. ID Card )

- Small change order certificate 500 yen worth

- Return envelope with stamp

- Power of attorney (when delegating charge)

● Remarks

- If the request is not your own Personal Information, in case of Personal information not owned by TSR, if TSR can’t verify your identity, if TSR can’t confirm facts as requested content, TSR can’t respond to requests for disclosure, correction, addition or deletion.

- In the case of 1, TSR will not return a fee.

- TSR will promptly notify you of results by mail.

- Personal Information in Publications and Articles may not be requested because they’re exempt from obligations by law.

Products & Services

Since TSR’s establishment in 1892, the TSR business information and its database has been an indispensable part of the social infrastructure in Japan.

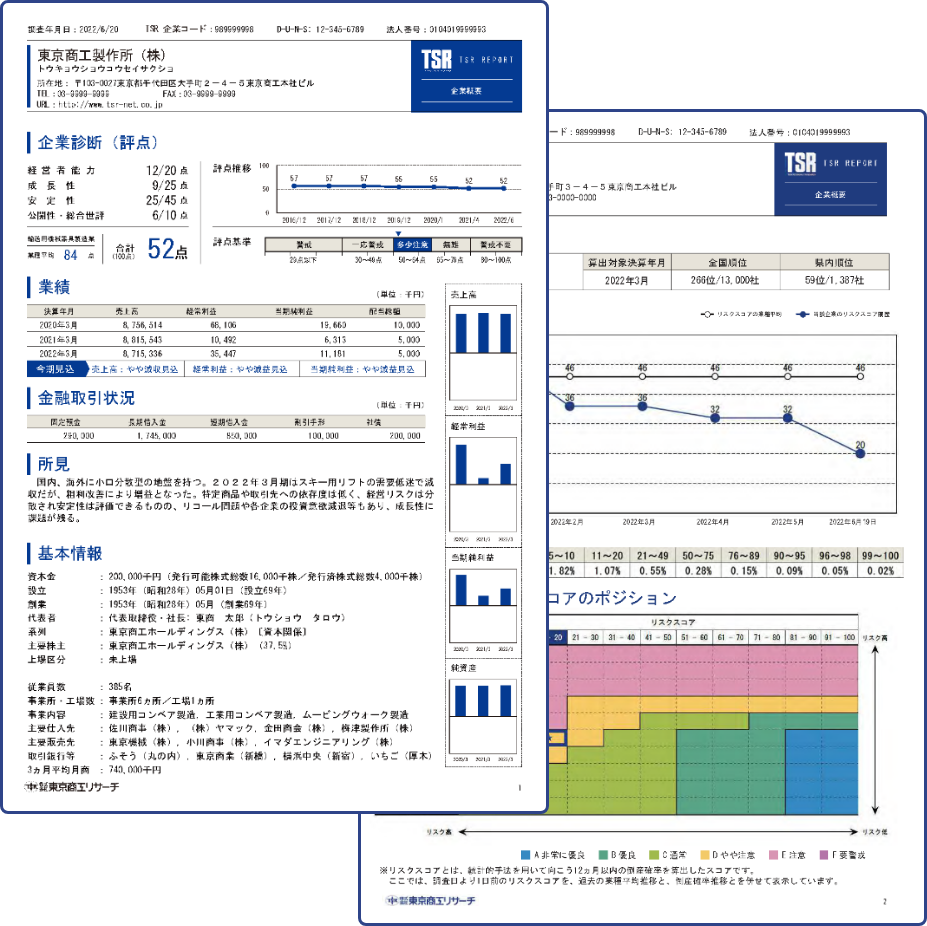

TSR REPORT

The TSR REPORT is a set of comprehensive credit information collected through site visit, direct interview and investigation by our professional reporters in 81 branch offices throughout Japan. Accurate and timely information is critical on the business-to-business transaction scenes and the TSR REPORT contribute business decisions with confidence.

Comprehensive report including TSR's credit rating.

● MANAGEMENT SUMMARY

● TSR CREDIT RATING

● HISTORY

● CAPITAL&SHAREHOLDERS

● DIRECTORS/PRESIDENT/BANKING

● OPERATIONS

● SETTLEMENT CONDITIONS

● ORGANIZATION

● BALANCE SHEET

● PROFIT AND LOSS STATEMENT

● PAST RECORDS(3 TERMS)

● FINANCIAL CONDITIONS

● COMMENTS

Database Services

TSR offers a variety of targeted lists which satisfy our customers’ needs. It is useful for sales and marketing or customer/supplier management.

Internet Services

In January 1999, TSR launched “tsr-van2” an Internet-based business information services. This service is available 24 hours a day, 365 days a year, and the tsr-van2 database of over 6 million Japanese business records is kept up-to-date through daily maintenance. Business profiles, financial data, bankruptcy information, marketing reports, etc. are all readily accessible via tsr-van2.

Business Failure News

We daily deliver the information of the companies who had business failures. Which company collapsed? Who are the creditors of them? These are critical information to prevent your company from chained bankruptcy or unexpected business risk. This accurate and precise data is highly evaluated by many companies, government offices, and mass media. Monthly and annually analyses are also available.

RISK SCORE (TSR/D&B joint product)

Risk Score assesses the risk level of your customers through a statistic method. The score is calculated using TSR's extensive database and D&B's predictive modeling know-how by analyzing data of previous bankruptcy cases. The Risk Score helps you to make credit decisions faster and consistent.

Marketing Services

TSR provides solutions for your marketing strategy like estimation of customers’ purchase trend, recognition of competitors activity, analysis of effective sales promotion through market scale assessment, market share research and so on.

Publication

TSR sells Japanese books ranging from "TOSHO SHINYO-ROKU," a leading directory on Japanese businesses, to the books taking advantage of long established TSR's financial analysis capability, as well as English books published by D&B to the customers in Japan.

Alliance with D&B

The D&B Worldwide Network - enabling customers globally to make business decisions with confidence.

The Dun and Bradstreet Corporation (D&B / NYSE:DNB) is the world’s leading source of commercial information and insight on businesses, enabling companies to Decide with ConfidenceR for 184 years. D&B’s global commercial database contains more than 600 million business records (as of Mar. 2025) . D&B is the leading provider of business information for risk management, sales & marketing, supply management decisions worldwide. More than 100,000 companies rely on D&B to provide the insight they need to help build profitable, quality business relationships with their customers, suppliers and business partners. TSR formed an alliance with D&B Japan since 2000 and has provided our customers in Japan with D&B’s quality solutions.

The D&B Worldwide Network is an unrivalled alliance of D&B and leading business information providers across the globe. Through this network customers gain access to worldwide business information, powered by D&B's proprietary DUNSRightR quality process, while benefiting from local expertise and knowledge.

According to the new strategic partnership agreement entered in February 2012, TSR takes over the customers which the joint venture, established on December 2007, was in charge of. TSR becomes the only entity who provides TSR and D&B products in Japan.

TSR is a member of the D&B Worldwide Network since 2005.

D&B Worldwide Network Members

| Company name | Main territory |

|---|---|

| D&B | (USA) USA, Canada, United Kingdom, Ireland (International) Hong Kong, China,P.R., India,Taiwan, Estonia, Gibraltar, Iceland, Latvia, Lithuania, Malta, Austria, Czechia, Germany, Hungary, Poland, Switzerland, Denmark, Finland, Norway, Sweden |

| Altares | France, Belgium, Netherlands, Luxembourg |

| CIAL Dun & Bradstreet | Argentina, Brazil, Mexico, Peru |

| CRIF | Italy, United Arab Emirates, Turkey, Egypt, Vietnam, Philippines |

| illion | Australia, New Zealand |

| D&B Indonesia | Indonesia |

| D&B Israel | Israel |

| D&B South Asia Middle East | Bahrain, Bangladesh, Bhutan, Iran, Iraq, Jordan, Kuwait, Lebanon, Maldives, Nepal, Oman, Pakistan, Qatar, Saudi Arabia, Sri Lanka, Syria, Yemen |

| D&B Singapore/ Malaysia | Singapore, Malaysia |

| D&B Thailand | Thailand |

| ICAP | Cyprus, Bulgaria, Greece, Romania |

| Informa D&B | Spain, Portugal |

| Interfax | Russia, Kazakhstan, Ukraine |

| NICE D&B | Korea |

| TransUnion | South Africa |